The Flow of Costs in a Job Order Costing System

They then assign the accumulated costs to Work in Process Inventory and eventually to Finished Goods Inventory and Cost of Goods Sold. Job order costing should be used if the production or service is being performed to meet customer specifications or requirements if different components are made for inventory or.

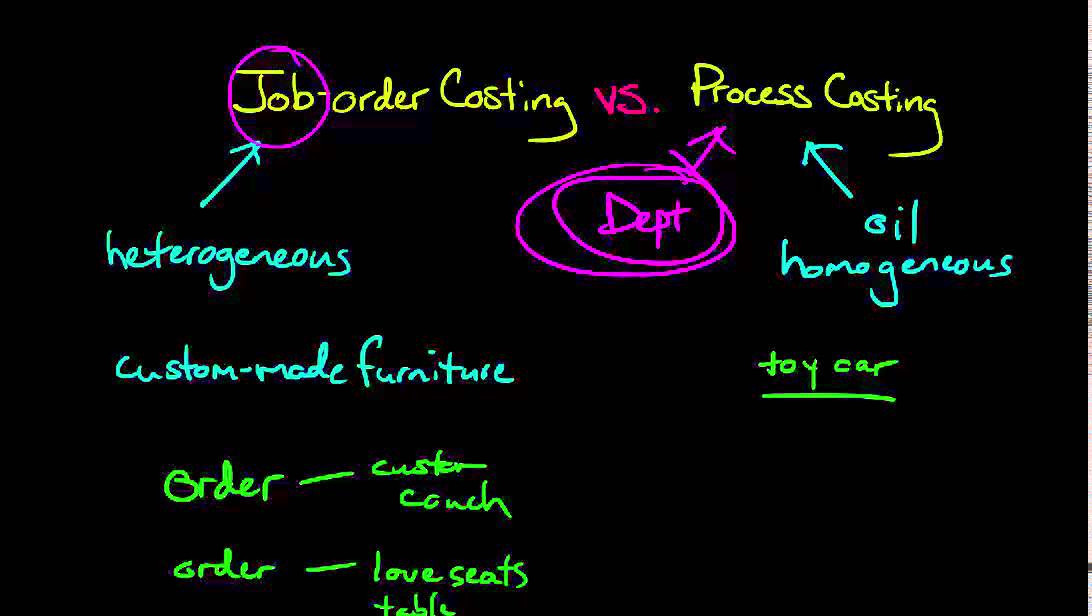

Amani Benn This Is A Diagram That Shows The Order We Follow When Using The Process Costing System I Am A Visual Learner So Diagrams Help Me Memorize Key Infor

Measures product costs for a set time period b generally follows a LIFO cost flow assumption.

. Set up the job costing sheet. Costs are tracked by job. Direct materials flow from Raw Materials Inventory to Finished Goods Inventory.

Actual Costing form of job order costing One type of job-order costing is called actual costing. The job order cost system is used when products are made based on specific customer orders. Job Order Costing 25 Densons job-order costing system has two direct cost categories direct material and direct manufacturing labor and one indirect cost pool manufacturing overhead which is allocated using direct manufacturing labor costs.

Describe the flow of costs in a job order cost system. The cost accumulation in a process costing system is simpler than in a job order costing systemUnlike job order costing system in which materials labor and overhead costs are traced to a large number of individual jobs the process costing system traces costs to only a few processing departments. 03-02 Use T-accounts to show the flow of costs in a job-order costing system.

Materials requisition form is prepared with the items from the bill of materials all the items needed for the job quantities and costs that will go into the job. As the costs begin to accumulate the costs of the units finished are assigned to the Work-In-Progress and Finished Products accounts until they are sold when those costs are recorded to the Costs of Goods Sold account. In the process planning we will cost by process.

The actual costing system like the name implies is a costing system that traces direct and indirect costs to a cost object by using the actual costs incurred in the job. To understand the flow of costs in job order costing system we shall consider a single months activity for a company a producer of product A and product BThe company has two jobs in process during April the first month of its fiscal year. Underapplied and Overapplied Overhead Learning Objective.

The correct cost flow in job order costing system is. Describe the flow of costs in a job order costing system. Describe the flow of costs in a job order costing system.

In job order costing companies. This system is used for small batch sizes and especially when the products within each batch are different from the products created in other batches. Identify the eight transactions.

Manufacturing cost Work in process Cost Cost of finished goods Cost of goods sold. The flow of the cost in a job-order costing system starts by recording the costs of labor raw materials and overhead. Indicate how the predetermined overhead rate is determined and used.

The purpose of a job order cost accounting system is to assign and accumulate costs for each job ie an order a contract a unit of production or a batch. For example service companies consider the creation of a financial plan by a certified financial planner or of an estate plan by an attorney unique jobs. Job 1 of 1000 units of product A was started in march.

The manufacturing industry keeps track of the costs of each inventory account as the product is moved from raw materials inventory into work in process through work in. The basic flow of costs in a job-order system begins by recording the costs of material labor and manufacturing overhead. Process 1 involved preparing the raw materials for printing process 2 is the actual printing and process 3 is packaging the planners to be moved to.

Prepare a flow chart of a typical job order system with the arrows showing the flow of cost. Materials Inventory Control Wages Payable Control 123120X3 13120X4 Balance 15000 Balance 3000 Manufacturing. In process costing system a separate work in process account is.

Job order costing can be used for many different industries and each industry maintains records for one or more inventory accounts. Each product produced is considered a job. This is where the numbers really start to come together.

03-04 Compute underapplied or overapplied overhead cost and prepare the journal entry to close the balance in Manufacturing Overhead to the appropriate. Job order costing system is a system for assigning and accumulating manufacturing cost of individual output units. QUESTION 3 6 points Save Answer Which statement is true regarding the flow of job costs through a job order costing system.

Knox Company begins operations in on January 1. Question The flow of costs in a job order cost system a. The manufacturing industry keeps track of the costs of each inventory account as the product is moved from raw materials inventory into work in process through work in process and into the finished goods inventory.

Explain the nature and importance of a job cost sheet. Raw Materials Inventory Factory Labor and Manufacturing Overhead. In these situations management wants to ensure that the costs incurred are reasonable when.

Direct labor costs flow from Work-in-Process Inventory to cost of Goods Sold. It is used to allocate costs based on specific order. Accumulating manufacturing costs incurred and assigning the accumulated costs to work done cannot be measured until all jobs are complete.

Distinguish between under- and overapplied manufacturing overhead. See the attached file for flow chart. 24 Prepare Journal Entries for a Job Order Cost System Although you have seen the job order costing system using both T-accounts and job cost sheets it is necessary to understand how these transactions are recorded in the companys general ledger.

This system determines the price of each individual product and ensures that the cost for each product is reasonable enough for a customer to purchase it while still allowing the company to make a profit. Services rendered can also be considered a job. In job order costing companies first accumulate manufacturing costs in three accounts.

These are the direct materials from the cost flow diagram. A job order costing system accumulates the costs associated with a specific batch of products. Because all work is done to customer specification the company decides to use a job order cost system.

The Flow of Costs in Job-Order Costing. Prepare entries for jobs completed and sold. Job order costing is a system that takes place when customers order small unique batches of products.

84 Tracing the Flow of Costs in Job Order Job order costing can be used for many different industries and each industry maintains records for one or more inventory accounts. The flow of costs in the process costing system is similar to in a job-costing system but lets review with our Ultimate Planner example. Direct material and direct labor costs are debited to the Work In Process account.

When units are sold their costs are credited to Finished Goods and debited to Cost of Good Sold. View Notes - Describe the flow of costs in a job order costing system from ACCT ac 202 at Montgomery College.

Purely Variable Costs For Example Direct Materials Variable Costs They Are Fixed In The Short Term For Example Direct Labour Fixed Costs They Become Va

Flowchart Manufacturing Process Process Flow Chart Template Process Flow Chart Flow Chart

Cost Benefit Analysis Example Analysis Business Analysis Inspirational Quotes Motivation

Cost Benefit Analysis Template Worksheet Templates At For Cost Analysis Spreadsheet Template Spreadsheet Template Worksheet Template Analysis

Cost Accounting Management Guru Cost Accounting Business Tax Deductions Accounting

Mario Armendariz This Pin Helps Explain The Difference Between The Job Costing And Process Costing Systems I Found This Helpful Because It Job System Process

Describes Job Order Costing Accounting Basics Managerial Accounting Information And Communications Technology

Xiaoqian Chen This Picture Describes The Job Order Cost Flow Process That Related To Chapter 17 The Job Order Costing System I Think It Helps Us To Easier Un

Introduction To Managerial Accounting And Cost Concepts Accounting Jobs Managerial Accounting Accounting

Cost Benefit Analysis Template Analysis Business Template Business Analysis

Key Kpi Sales Performance Metrics Examples Sales Techniques Sales Training Marketing Analysis

Cost Per Hire Metrics Employee Onboarding Training And Development Change Management

Which Of The Following Would Be Accounted For Using A Job Order Cost System In 2022 Accounting Job System

Inventory Management Flowchart Flow Chart Business Process Management Management

Excel Templates Cost Sheet And Bill Of Materials For Product Etsy Cost Sheet Excel Spreadsheets Templates Excel Templates

Tsedenya Gebreyesus In This Video He Explains And Goes Into Details About The Differences Of Job Order Costing And Process Costing He Job Relatable Process

This Flow Chart Is Important To Understand As It Helps To Show How To Determine The Cost Of Goods Ma Cost Accounting Managerial Accounting Accounting Education

Ira Kulkarni This Video Explains The Difference Between Product Cost And Period Cost With Examples It Also Goes Over Eac Visual Learners Period How To Split

Comments

Post a Comment